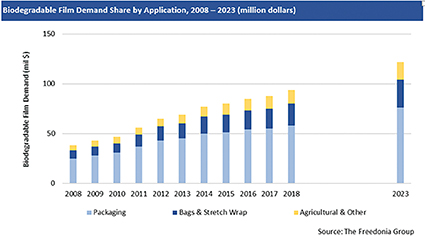

Demand for biodegradable plastic film is expected to climb 5.4% yearly to $122 million in 2023

Food packaging will remain the dominant market for biodegradable films and is expected to account for 62% of demand in 2023. Biodegradable films will increasingly be employed in the production of salad, produce, and other food bags, as well as in labels. Additionally, biodegradable plastics usage in overwrap and other films – including those used as twist wrap, cut and wrap, twist film overwrap, and candy wrappers – will continue to make inroads vis-à-vis conventional films. PLA is currently the leading product in the packaging film market and is expected to offer some of the best opportunities for growth through 2023, benefiting from favorable properties such as high clarity, twist retention, printability, strength, and flavor and aroma barriers. These and other trends are presented in Specialty Films, a new study from The Freedonia Group, a Cleveland-based industry research firm.

Demand for biodegradable bags is also expected to rise rapidly through 2023

Advances will be driven by an expanding composting infrastructure and governmental efforts to reduce landfilling, which will boost demand for compostable bags used in the collection of food scraps and other organic materials for waste diversion programs. Overall advances will be restrained to some degree by the inability to substantially widen the national scope of composting networks, as well as competition from kraft paper bags.

Demand for all types of specialty films (barrier, microporous, safety and security, conductive and insulative, light control, water soluble, biodegradable and other) is forecast to advance 4.0% annually to $9.0 billion in 2023

The fastest gains will be in the biodegradable and water soluble film segments, the result of rapid growth in markets such as degradable packaging for food and nonfood items such as laundry detergent pods and oral drug delivery strips. Other smaller volume functions, which include tapes and release films, will also see above average gains in demand through 2023.

The fastest gains will be in the biodegradable and water soluble film segments, the result of rapid growth in markets such as degradable packaging for food and nonfood items such as laundry detergent pods and oral drug delivery strips. Other smaller volume functions, which include tapes and release films, will also see above average gains in demand through 2023.