Asahi Photoproducts recently presented the results of an independent study conducted by Professor Lixin Mo from the Beijing Institute of Graphic Communication (BIGC), analyzing carbon emissions in China’s packaging printing sector. This contribution is particularly relevant in light of the country’s “dual carbon” strategy—which aims for peak carbon emissions by 2030 and carbon neutrality by 2060—and offers insights into the roles that flexographic and gravure printing technologies can play in this transition.

By Yuji Suzuki, Asahi Kasei

Lixin Mo, Beijing Institute of Graphic Communication (BIGC)

In East Asia, especially in China, packaging is more than just a functional element—it strongly influences consumer perception of product quality. This has long favored the use of gravure printing, known for delivering excellent print quality and still representing more than 90% of flexible packaging production in the country.

However, as environmental awareness grows, flexo has made significant advancements in print quality and process reliability. In fact, flexo today accounts for about 50% of the European packaging market and over 70% in the U.S., particularly in labels and paper-based applications.

The study: methodology and sample

The research was carried out between October and December 2023 and involved 28 Chinese printing companies specializing in labels, paper packaging, and flexible packaging. The sample included 12 flexo printers and 16 gravure printers. Data was collected via structured questionnaires and on-site visits, focusing on production processes, emission sources, environmental certifications, and the use of inks and lamination technologies.

This data enabled a comparative analysis of the carbon footprint per unit of printed product, providing valuable guidance for both industrial strategy and public policy in support of more sustainable production models.

Production processes, inks, and lamination methods

One key finding concerns the impact of material and process choices. For example, dry lamination, widely used in gravure (78.6% of respondents), requires solvent-based adhesives and generates high VOC emissions. In contrast, solventless and extrusion lamination, more common among flexo printers, are considered lower-impact alternatives.

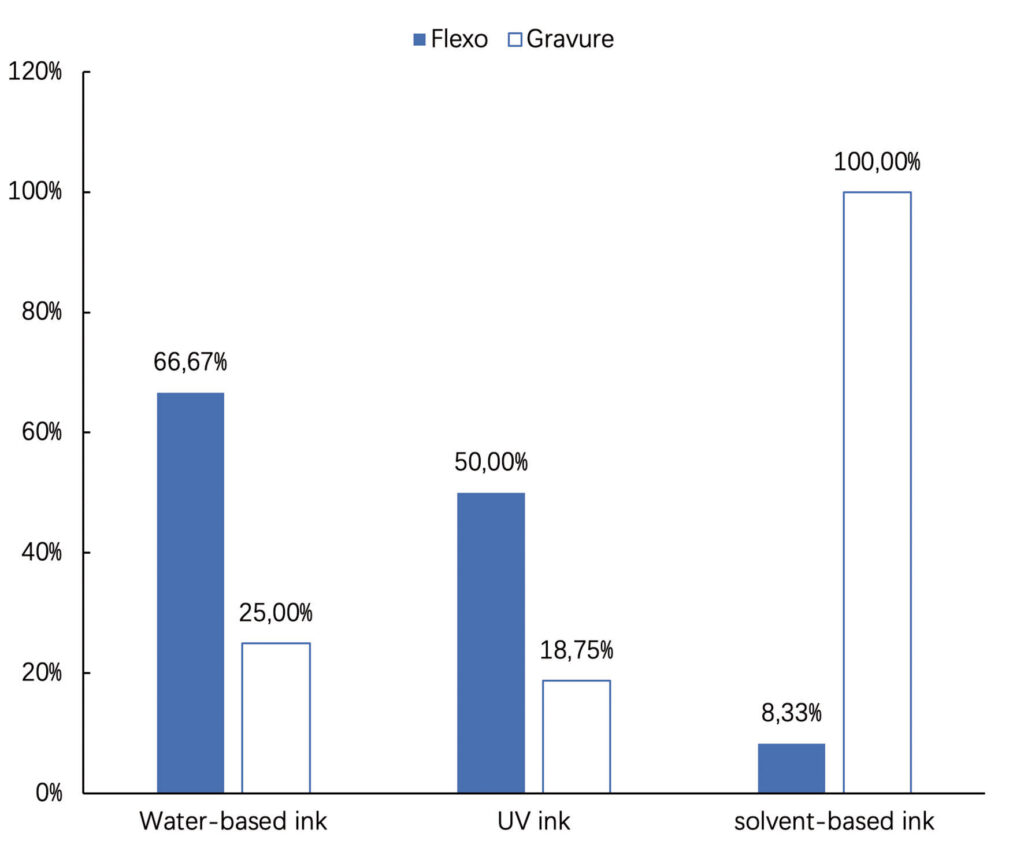

Inks are also a major factor. Solvent-based inks are still predominant in gravure, while flexo printers report higher adoption of water-based (66.7%) and UV inks (50%), both of which produce minimal VOC emissions.

Environmental certifications and emission control systems

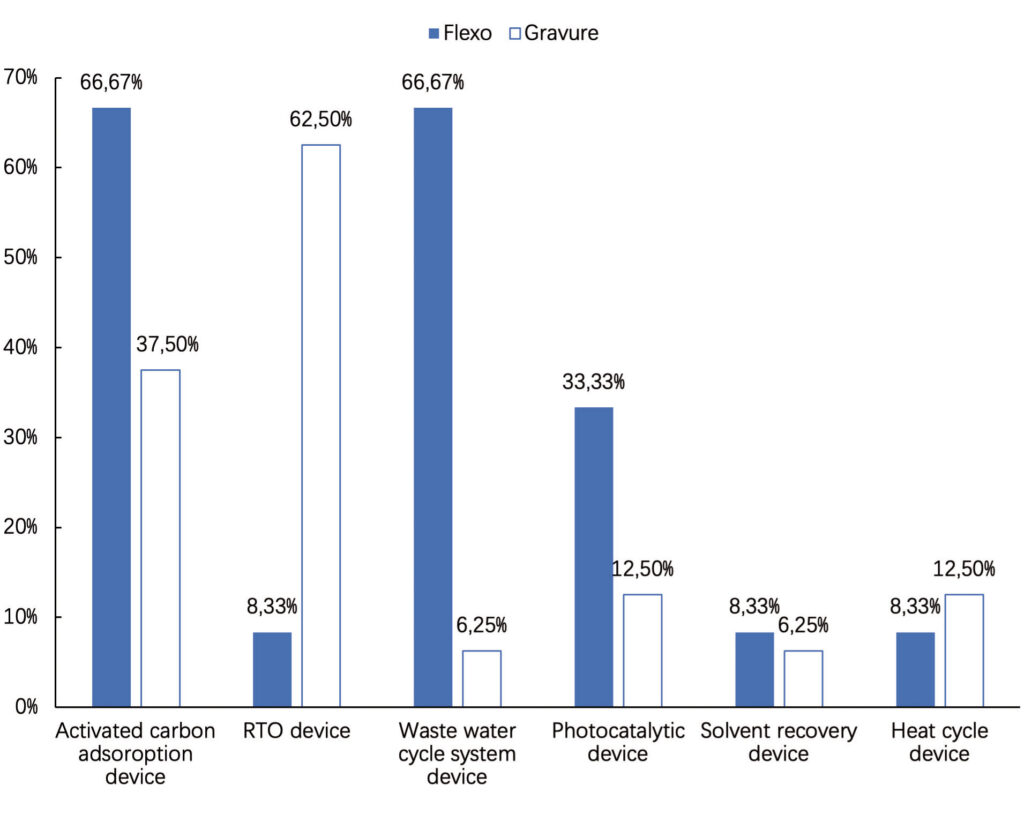

Among the flexo companies surveyed, 75% had obtained one or more environmental certifications (such as FSC or environmental management systems), compared to 31.25% of gravure companies. Differences are also notable in emissions control technologies: gravure printers, due to the use of solvent-based inks, often rely on high-efficiency regenerative thermal oxidizers (RTOs). In contrast, flexo companies using water-based or UV inks can often meet environmental standards with less energy-intensive carbon adsorption systems.

Another point—though not directly included in the study—concerns plate and cylinder preparation. Water-wash flexo plates, for example, are generally more environmentally friendly compared to processes involving solvents or high-energy engraving used for gravure cylinders.

Results and future outlook

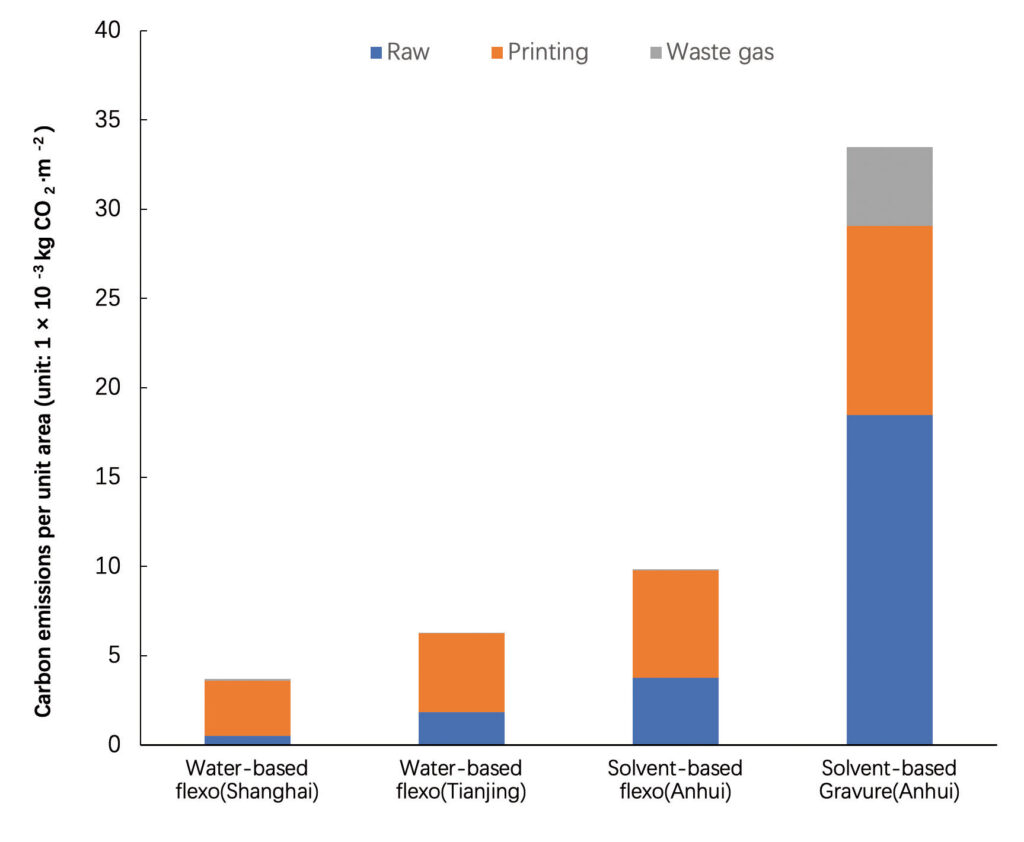

The study ranks carbon emissions from lowest to highest as follows: water-based flexo, solvent-based flexo, solvent-based gravure. This does not diminish the technological or quality advantages of gravure but instead highlights the need for strategic consideration of lower-impact alternatives in alignment with China’s environmental goals.

A transition toward more sustainable technologies—including broader adoption of flexo and eco-friendlier inks and laminations—represents both an industrial challenge and a market opportunity. Chinese consumers and global brands are increasingly focused on sustainability, and aligning with these expectations could become a key competitive advantage.

Of course, such a shift requires targeted investment and regulatory support. But the study shows that viable solutions are already available, and that the industry has concrete paths forward to ensure long-term sustainability—without compromising the high quality that the market continues to demand.